Bitcoin Mining and Taxes

Created

IRS Memo

Internal Revenue Service Memo 2014-21 provides the only official guidance about Bitcoin taxation in the United States. The summary below is a starting point for understanding. Consult a tax professional for up-to-date, expert guidance about your tax situation.

Bitcoin Mining Income

The IRS memo states that Bitcoins you receive from your mining activity must be included in your gross income. You must report the fair market value (in US dollars) as of the date you receive the Bitcoins.

Examples of reportable mining income are:

- Block rewards from solo mining

- Mining pool payouts

- Mining rentals

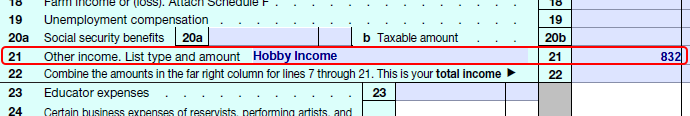

Small scale miners can report mining income as hobby income on as Form 1040, Individual Tax Return, line 21.

Larger scale miners can report mining income with gross receipts and sales on Schedule C, Profit or Loss From Business (Sole Proprietorship), line 1.

Bitcoin Mining Expenses

Your Bitcoin mining activity may incur expenses such as electricity, rent, and myriad others. Expenses paid in Bitcoins must be valued at their fair market value (in US dollars) as of the date of payment.

Hobby income may be offset by mining hobby expenses reported on Schedule A, Itemized Deductions, line 23. Hobby expenses may not exceed hobby income.

Small business income may be offset by expenses categorized on Schedule C, Profit or Loss From Business (Sole Proprietorship).

Fair Market Value

Bitcoin transactions must be reported in U.S. dollars for tax purposes. You must determine the fair market value of Bitcoins paid or received in a reasonable manner that is consistently applied. Most transactions can be reported with one of these approaches:

- Actual Cash Value

- You buy or sell Bitcoins at an exchange, you pay or receive U.S. dollars. For example, you buy $1,000 of Bitcoins at Coinbase.com. Your fair market value is $1,000.

- Equivalent Value

- You buy or sell goods or services with an established U.S. dollar value. For example, you purchase electronics products worth $219.83 (with sales tax and shipping) from Newegg.com. You pay with Bitcoins that have a fair market value of $219.83.

- Current Bitcoin Value

- You send or receive Bitcoins at the current Bitcoin value. For example, a mining pool sends you a reward of 0.1 Bitcoins on February 18, 2018 at 4 PM. At that moment, one Bitcoin is worth $10,772.43. Your fair market value is $1,077.24.

- Historical Bitcoin Value

- You sent or received Bitcoins that must be valued based on historical Bitcoin prices. For example, a mining pool sent you a reward of 0.1 Bitcoins on February 18, 2017 at 4 PM, but you did not record the Bitcoin value at that time. You review the CoinDesk Bitcoin Price Index to learn that one Bitcoin was worth $1,190.89 on February 18, 2017. Your fair market value is $119.09.

You may establish the fair market value in another real currency which in turn can be converted into U.S. dollars.

Capital Gains

When you sell or spend your Bitcoins at a fair market value higher or lower than when you received them, you will have a capital gain or loss.

For example, you received a mining pool reward of 0.1 Bitcoins on February 18, 2017. You received Bitcoins with a fair market value of $119.09 (from the example above). You sold your 0.1 Bitcoins at the 2017 peak price of $19,343.04 on December 17. Your sold Bitcoins had a fair market value of $1,934.30. Your capital gain was

$1,934.30 – $119.09 = $1,815.21.

Transactions involving Bitcoins held for one year or less are short term. Report short term sales on Form 8949, Sales and Other Dispositions of Capital Assets, Part I.

Other Bitcoin transactions are long term. They are taxed at a lower rate. Report long term sales on Form 8949, Part II.

Bitcoin sales and spending results in a taxable event. However, the record keeping burden begins when Bitcoins are received.

Bitcoin Cash and Other Forks

New tax questions arose when Bitcoin Cash forked from Bitcoin on August 1, 2017. Your Bitcoin holdings as of block 478558 on that date were supplemented by equal holdings of Bitcoin Cash.

The IRS has not provided guidance about Bitcoin Cash and similar forks. You probably should choose one of these strategies recommended by Bitcoin tax experts.

- Bitcoin Cash Had Zero Basis

- Record the receipt of your Bitcoin Cash at $0 cost. When you later sell your Bitcoin Cash, report a capital gain for the full fair market value. This strategy was one of two suggested by Aaron Stanley at CoinDesk.

- Bitcoin Cash Had Some Basis

- Record the receipt of your Bitcoin Cash at the price on August 1, 2017, around $270 depending on your data source. Report that fair market value as other income on Form 1040, Individual Tax Return, line 21. When you later sell your Bitcoin Cash, report a capital gain or loss depending on the fair market value when you sell. This strategy was the second of two suggested by Aaron Stanley and was also suggested by Robert A. Green of Forbes and the staff at Bitcoin Taxes.